Learning from tax time, building for financial health: highlights from SaverLife’s member campaign

As tax season comes to a close, we’re reflecting on the many ways SaverLife worked to support its members’ tax season journey.

Tax season is pivotal for SaverLife members. Many often rely on their tax refunds all year long, using them to pay down debt, get ahead on monthly expenses, and maybe even put some money away for the future.

That’s why this year — and every year — SaverLife hosts a robust Tax Time campaign that addresses our members’ most pressing tax goals and needs. Their stories and feedback anchor all of the tax time content, activities, rewards, and incentives. Because it matters that our members get the support that they need to file with confidence and maximize their tax refunds.

How did we engage and support SaverLife members during the 2024 tax season? Check out the highlights and outcomes from our 2024 Tax Season member campaign in our latest impact report.

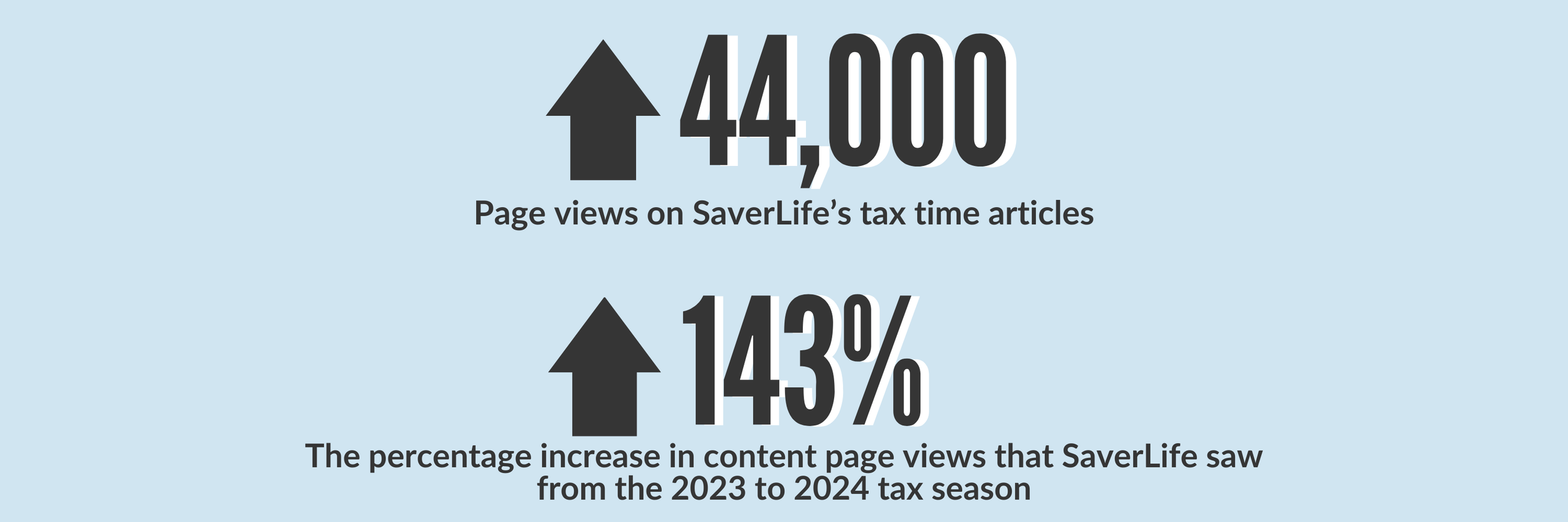

Learn: Members used SaverLife content to navigate the tax system

Because SaverLife members live very different lives, we produced content that addresses the unique and complex ways that our members interact with taxes. Our 10 articles and 2024 Tax Time Guide spanned topics like:

With 100% free access to content written by certified financial coaches, SaverLife aimed to support members to get every tax dollar they deserve.

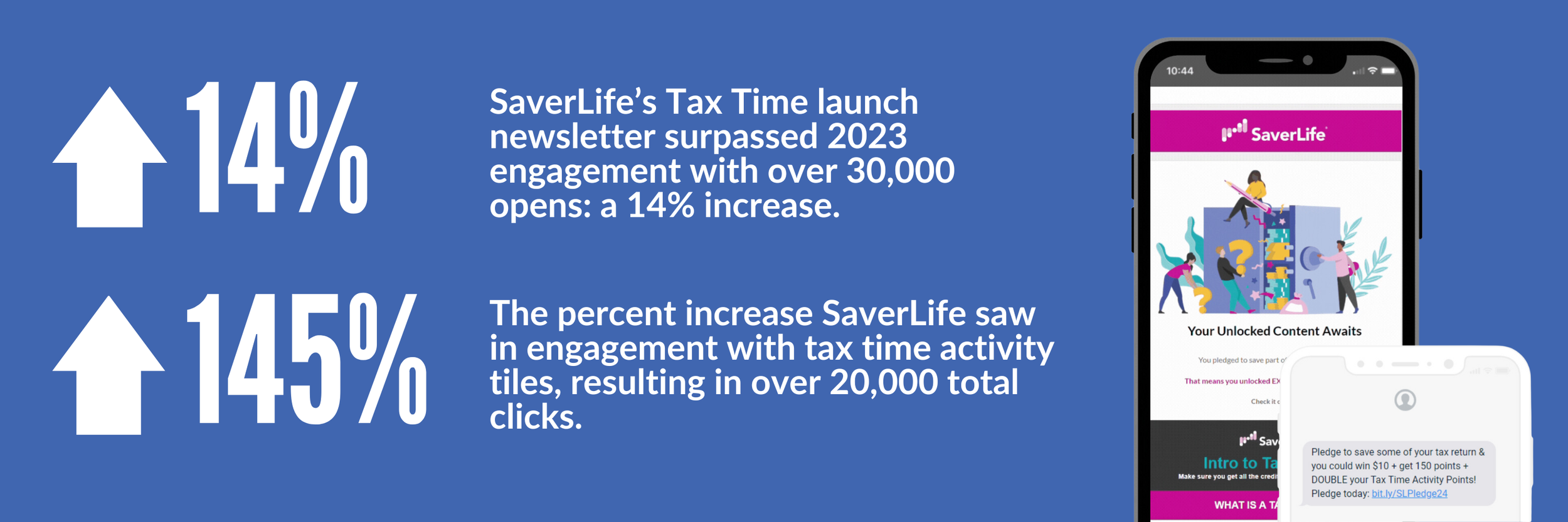

Earn: Challenges and incentives encouraged members to save for long-term goals

While SaverLife has uncovered that many of our members use their tax refunds to make ends meet, they’ve also shared that they try to set some of the money aside for the future, like building an emergency fund or saving to buy a home.

To support these goals, we hosted the Tax Time Pledge and “Save Your Refund” challenge, encouraging SaverLife members to put away at least $150 of their tax refunds. By supporting members to build up their savings, we aimed to promote healthy savings habits at tax time and support our member community to leverage their refunds for immediate and long-term financial goals.

Our full tax time user journey encouraged members to:

Pledge their tax refund to savings for a chance to win $10

Participate in the “Save Your Refund” challenge and save $150 by March 31st for the chance to win up to $5,000

Build up participation points by completing all tax-related activities and reading our content series

After filing her 2023 tax return, SaverLife member Amy discovered that she owed over $500 in property taxes that she hadn’t originally planned for. Thankfully, she participated in the “Save Your Refund” challenge, and won almost the same amount of money that she owed in taxes. These winnings brought Amy instant relief, because she would no longer need to ask her family for support covering her property taxes. “It was such a surprise to win the challenge,” she concludes. “I’m grateful to SaverLife.”

Share: Member storytelling to highlight the deep connections between financial health and tax time

SaverLife spoke with three of our members to learn more about the ways they navigate tax time. Each story explores the positive impacts of tax refunds and credits on their lives. They also complicate how we collectively think about tax season and the implications it can have on financial health and well-being, especially for households living on low-to-moderate incomes.

While no one story about tax time is the same, as we spoke with our three members about their filing and planning processes, we noticed some common themes:

They budget for their tax refunds all year long

They see tax time as a major learning opportunity

They use their tax refunds to maintain financial stability

To them, tax season raises complicated emotions about their financial situation

They want to share their tax time learnings and empower others to make more informed choice

We’re just getting started: Tax time next steps, and how you can join our work

Tax time isn’t just an integral part of our members’ financial health journeys: it's one of our members' biggest (if not the biggest) cash infusion of the year. It’s also a key component of SaverLife’s work to uncover the infinite ways that finances interact with our lives, goals, and plans for the future — and how we can shape the financial system to better reflect these complexities.

Just like our members, SaverLife works to better understand tax time all year long. Even though the 2024 tax season has come to a close, our members will still be planning and preparing for it in the months to come. To ensure that they have the right information and resources, we will continue sharing insights and recommendations on ways that the tax system can better support their efforts.

In the coming weeks, you can expect to see new findings from our latest research survey that explores the positive impacts of tax time on SaverLife members. You can also stay up to date on our latest research by subscribing to our monthly research newsletter.