SaverPerks Program Launches to Help Members Build Financial Resilience

New cash rewards program helps members save money and earn income.

At SaverLife, we’re always looking for new ways to help our members build financial resilience. One of the most important ways we do this is through helping members build emergency savings. We also know that decreasing spending and increasing income opportunities can improve long-term financial health.

The winners of SaverLife’s first Science of Savings challenge, Datable Services, found that building a savings habit was not the only financial tool that could benefit members.

“We looked at how individual users spent money at different merchants and in different categories,” Matt Lichti, one of the Datable team members, said. “That’s how we came up with the idea that reducing the frequency of spending would help users save money overall.”

Our members report they not only use SaverLife to save money but to find financial resources.

“I find a lot of resources through SaverLife,” Gena, a SaverLife member from Maryland, said. “The consistency helps me focus on getting more income and reaching my financial goals.”

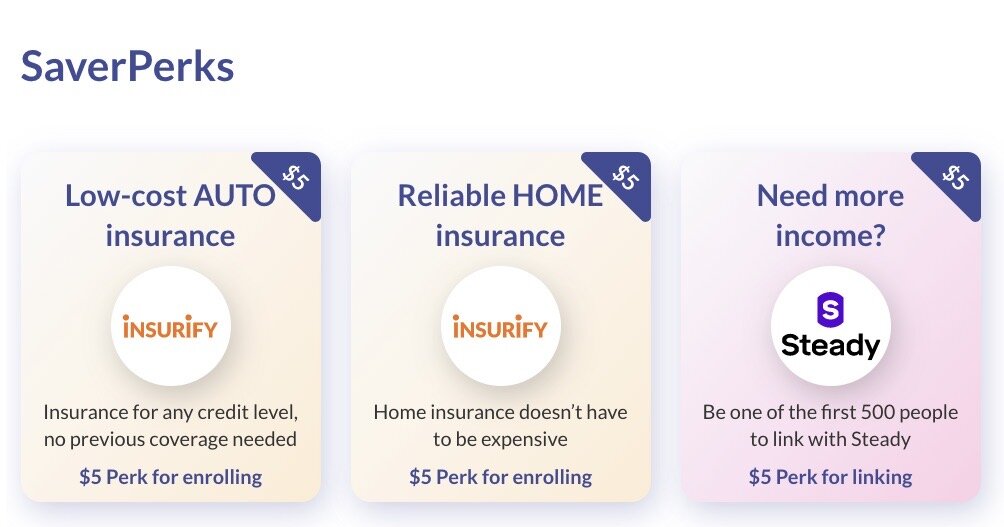

That’s why SaverLife recently launched SaverPerks, a member offers program that shares carefully vetted partners for members to save or earn more money while building up their savings. SaverLife provides a financial incentive to drive engagement for partners who opt into a cashback offer.

“We want to help members find opportunities that help them to save more money, either by spending less or earning more income,” Neha Gupta, Vice President of Marketing at SaverLife explained.

SaverPerks launched with three offers from partners, including auto and home insurance through Insurify and an income-earning opportunity through Steady. To receive the financial reward, all members have to do is go through the steps to sign up.

One example of a successful SaverPerk is Steady. Initial data shows that earning more money is a key perk our members are interested in.

SaverLife launched a pilot in November 2020 with Steady, to cross-promote our services. Fifty-four percent of participants improved their Financial Health Score and were 27% more likely to increase their savings balance. We expanded the successful pilot into a full SaverPerks program that includes Steady as an ongoing partner.

“We’re focusing on partnerships for products and services that everyone needs, such as insurance and utilities,” Gupta said. “We’re also focusing on partnerships that will help our members earn more income.”

SaverLife currently features five SaverPerks and hopes to include as many as 12 in the future.

“There are not a lot of platforms that can connect partners with users who are motivated to take advantage of offers that help them build their savings,” Gupta said. “That’s a real differentiating factor for SaverLife.”