Missing Out on Crucial Child Tax Credit Relief: Who Is at Risk and Why

July 15, 2021

Starting today, direct payments of the Child Tax Credit will reach millions of families across the country, marking a significant moment in our country’s history. Through automatic monthly payments, help is on the way for families with children who are struggling to pay for groceries, rent, or utilities, build rainy day funds, afford child care, and meet the many other expenses parents face.

SaverLife, in partnership with the Economic Security Project, studied access to information about the Child Tax Credit to understand if member families are aware of the expanded credit and have taken steps to claim it.

We found widespread disparities in access to information, misconceptions about eligibility, and limited options to claim the funds.

Key Takeaways:

Two-thirds of respondents have not heard a lot about the expanded credit and what it means for them, and nearly 30% indicate having only heard “a little” or “nothing”.

One in five SaverLife members hasn’t filed taxes this year. Seventy-eight percent of non-filers have heard some, little, or nothing about Child Tax Credit. Many are unaware that they must take additional steps with the IRS to receive their credit.

Non-filing parents are 2x as likely to be misinformed about eligibility.

Taking action now to help families claim the Child Tax Credit will help millions of families pay their rent or utility bills, prepare for an upcoming school year for their children, and more.

On July 15, 2021, direct payments of the Child Tax Credit will be deposited in millions of bank accounts across the country, marking a significant moment in our country’s history and the largest expansion of the Child Tax Credit program. Through automatic monthly direct deposits and checks, help is on the way for families with children who are struggling to pay for groceries, rent, or utilities, build rainy day funds, afford child care, and meet the many other expenses parents face.

The Child Tax Credit has been in place since 1997, but, like the Earned Income Tax Credit, it has traditionally been distributed in a lump sum at the same time as tax refunds. The American Rescue Plan, signed into law by President Biden on March 11, 2021, expands the Child Tax Credit for one year: almost all families with kids, from low-income single parents to married couples earning upward of $400,000 a year, are eligible for this crucial relief, including those who have not made enough money to be required to file or owe taxes. For the first time, starting in July, the IRS will send families half of the 2021 Child Tax Credit in monthly payments of $300 per child under age six and $250 per child ages six to 17. Families will receive the remainder of the credit when they file taxes in 2022.

The expanded Child Tax Credit has the potential to end extreme poverty—and cut child poverty in half—especially among Black and Native American children. But only if the help reaches families.

SaverLife, in partnership with the Economic Security Project, studied access to information about the Child Tax Credit to gauge if families with eligible dependents are aware of the expanded credit and have taken steps to claim it. Our polling found widespread disparities in access to information, misconceptions about eligibility, and limited options to claim the funds.

Unless all families are informed about how to claim the Child Tax Credit—especially those with lower income levels and those in communities of color—they risk missing out on the benefit. Taking action now to help families claim the Child Tax Credit will help millions of families pay their rent or utility bills, prepare for an upcoming school year for their children, and more.

Discrepancies in Awareness and Misconceptions About Eligibility

SaverLife polling found wide discrepancies in awareness of the expanded Child Tax Credit and misconceptions about eligibility among low-to-moderate income households—risking access to help for those families who most need it. Two-thirds of respondents have not heard a lot, and nearly 30% indicate hearing “a little” or “nothing” about the Child Tax Credit and what it means for them.

Misconceptions

Misconceptions about the Child Tax Credit around the topics of eligibility, future tax liability, and other public benefits, are many.

Eligibility

Although it is likely all respondents are eligible to receive the Child Tax Credit, many people may not realize they are eligible.

Twenty-four percent aren’t sure whether or not they’re eligible to receive the payment.

An additional 14% believe they are ineligible.

For those who believe they are ineligible, many believe—incorrectly—that receiving federal benefits such as SNAP makes them ineligible to receive the Child Tax Credit.

Non-Filing Parents Need Better Information and Access

One in five SaverLife families has not filed taxes, likely due to either their income or age. Among these members, there is a widespread discrepancy in access to information and understanding of the Child Tax Credit.

Seventy-eight percent of non-filers haven’t heard a lot about the expanded Child Tax Credit.

Of the 78% of non-filers, almost half have heard little or nothing about the expanded Child Tax Credit.

Compared to those who typically file taxes, a non-filer is 20% more likely to have heard little, or nothing, about the benefit.

Twenty-seven percent of non-filers expect to receive the payments, and yet the vast majority also said they haven’t heard much about the Child Tax Credit. This suggests that many incorrectly expect to receive the credit without taking any other action.

Helping Families Claim The Child Tax Credit

Eighty percent of SaverLife members are parents, 59% identify as a person of color, and 70% do not have a college degree. They rely on multiple sources of income to get by and often lack access to the levers that build wealth.

Taking action now to help low- to moderate-income families claim the Child Tax Credit will help millions of families pay their rent, utility bills, and prepare for the upcoming school year.

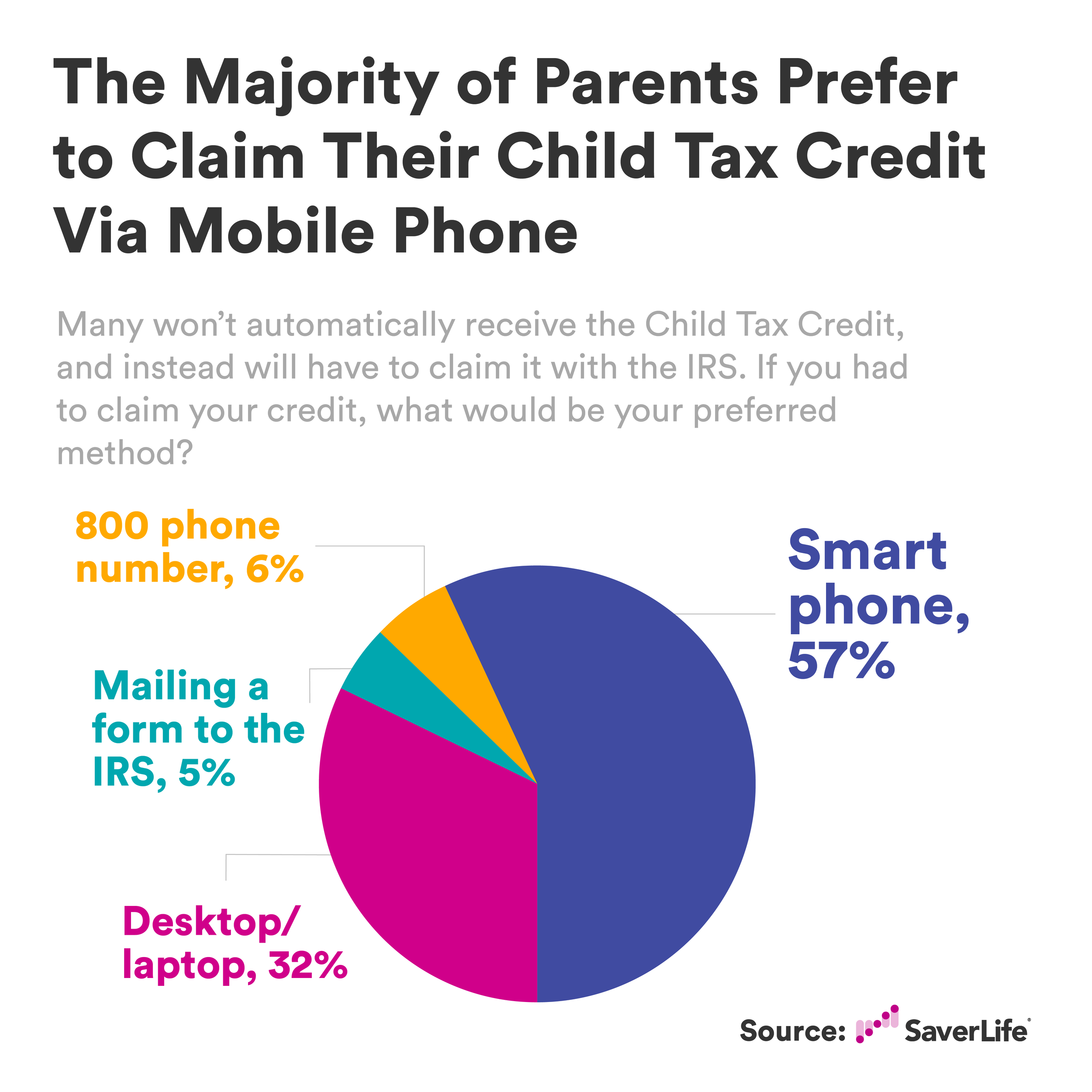

Many families have struggled to access the IRS non-filer portals. The majority of SaverLife households (57%) would prefer to claim their money via mobile phone compared to a computer or other methods. A mobile phone option was 79% more popular than desktop and more than five times more popular than other options, such as mail or a 1-800-number for customer service.

Targeted awareness around the Child Tax Credit will help ensure that every dollar reaches low-to-moderate income (LMI) households, especially in communities of color. Key messages from trusted community members and partners can help make a tremendous impact in helping people to access the credit.

SaverLife’s unique platform offers the capability to reach local communities with trusted information about key policies that impact their financial well-being. We have a history of delivering and sharing federal tax-related content, and our digital channels allow us to swiftly and accurately share information directly to households in a digestible and timely format. In addition, our community forum offers an online space for households to connect directly with one another, share knowledge, experiences, and solve problems collectively in real-time. SaverLife will conduct targeted awareness around the Child Tax Credit to ensure that the credit reaches low-to-moderate income (LMI) households, especially in communities of color, and elevate their experiences with the Child Tax Credit to reach the broader community and key stakeholders.

Methodology

Based on the survey responses of 498 individuals who identified as having dependent children. Responses were collected between June 17th and June 24th, 2021.