New findings: Exposure to climate-related events causes economic pain for SaverLife members

When it comes to financial stability, SaverLife members are no stranger to making regular trade-offs in order to meet their basic needs. But more recently, they’ve also had to account for the financial ripple effects that come as a result of climate change, creating an even more precarious balance for their financial health.

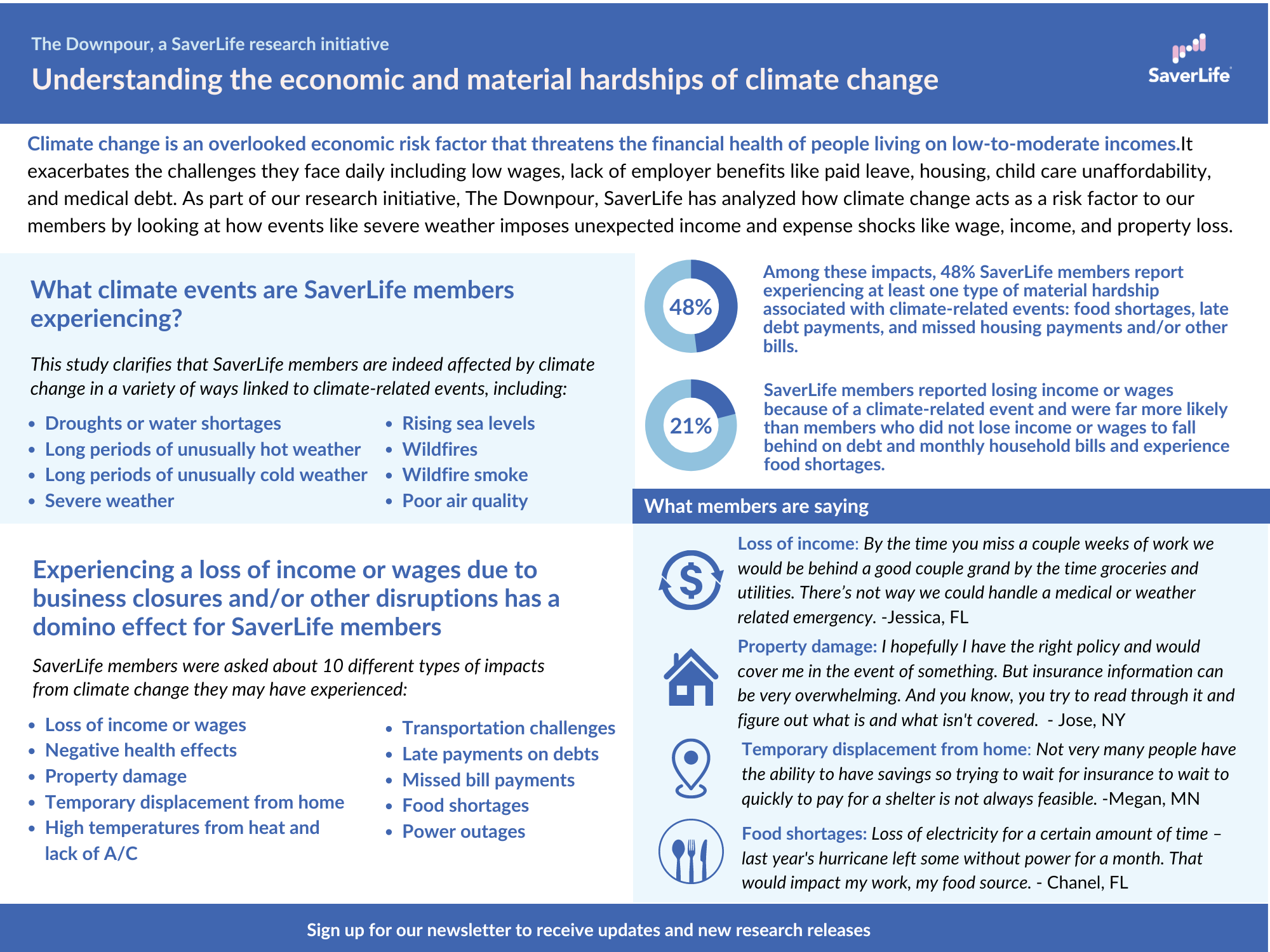

In the latest phase of our research initiative, The Downpour, SaverLife looks at the economic and material hardships our members — people living on low-to-moderate incomes (LMI) — face as a result of the impacts of climate change. This is an often overlooked piece of the climate puzzle and one that has widespread implications for our members and their financial health. The most significant finding SaverLife confirmed through our research is that our members are unable to absorb the shocks and disruption of severe weather events without experiencing financial harm.

By understanding how members are experiencing these climate events, and the consequences they have on other areas of their lives, there is an opportunity for policy makers to ensure these realities and challenges are prioritized. In order to build climate resilience, programs must be designed to meet the needs of households earning low-to-moderate incomes.

SaverLife members experience climate change in many forms

Climate-related events are happening on a regular basis and challenging SaverLife members’ financial stability throughout the year. The impending realities of more frequent and disruptive climate-related events become concerning when coupled with the fact that 65% of SaverLife members predict needing at least $3,000 to recover from a disaster, despite maintaining an average of $1,366 in savings.

When asked if their communities had experienced climate-related events within the past 12 months, on average, SaverLife members report experiencing 3 out of these eight event types:

Droughts or water shortages

Long periods of unusually hot weather

Long periods of unusually cold weather

Severe weather

Rising sea levels

Wildfires

Wildfire smoke

Poor air quality

For SaverLife member Megan, she recognizes how the physical effects of summer temperatures impact her paycheck. When the hot weather upsets her asthma, she has to cut back on the number of hours she can work. This in turn leads to fluctuating income, and fluctuating income further delays her financial health goals like paying down credit card debt. In short, Megan not only needs to prepare for when the hot weather will upset her asthma: she also needs to account for resultant reductions in work hours, disruptions to her monthly budget, increased stress levels, and delays to her longer-term financial goals — realities that she doesn’t feel she even has the time or energy to think about right now.

“As far as climate change goes, I can only prepare for the changing temperature,” she explains. “I can only take care of what’s in front of me right now.” Megan’s income fluctuations with summer temperatures reflects a growing body of feedback from SaverLife members who have seen a climate-related event lead to material or financial hardship in their own lives.

Severe weather predicates material hardships

Data shows that 48% of SaverLife members reported experiencing at least one type of material hardship associated with climate-related events, like food shortages, late debt payments, or missed housing payments. Additionally, 21% of SaverLife members reported losing income or wages because of a climate-related event. They were also far more likely than members who did not lose income or wages to fall behind on debt and monthly household bills and experience food shortages.

We uncovered that, while members are experiencing an average of three climate event types, this exposure to climate events also comes with increased financial hardships, including:

Loss of income or wages

Negative health effects

Property damage

Temporary displacement from home

Food shortages

Transportation challenges

Late payments on debts

Missed bill payments

High temperatures from heat and lack of A/C

We also learned that 50% of members who lost wages had food shortages compared to 15% of those who did not. Thus, experiencing the loss of income or wages due to business closures and/or other disruptions has a domino effect for SaverLife members.

For example, SaverLife member Jessica experienced the interconnectedness of climate change and her financial well being when a severe weather event threatened her family. She recognized that if they had to evacuate their home and miss work, this reduction in monthly income would make it challenging for her to cover necessary expenses and avoid increasing debt. “By the time [we’d] missed a couple weeks of work,” she explains. “We would be behind a good couple grand [for] groceries and utilities. There’s no way we could handle a medical- or weather-related emergency.”

Planning for the future and building climate resilience

Climate change is yet another economic risk factor that threatens SaverLife members’ financial health, added to a list that includes low wages, lack of employer benefits like paid leave, housing and child care unaffordability, and medical debt. We believe that building resilience to climate change is a key factor in ensuring that climate-related events do not push households into greater financial precarity.

And while families are increasingly experiencing the economic hardships of climate change, the United States is simultaneously making unprecedented investments to transition to a decarbonized economy. The passage of the Inflation Reduction Act (IRA) is a monumental investment to address the threat of climate change, reduce energy costs for American households, and create new economic opportunities from which everyone could benefit. To ensure these benefits reach our members, we need to work to understand the needs and perspectives of the LMI community and take action to strengthen their ability to adopt climate resilience strategies that enable them to fully participate. We also need to understand our members' awareness of programs designed to alleviate the immediate economic impacts of severe weather events and natural disasters and how SaverLife members are (or aren’t) able to access public benefits and financial assistance programs like FEMA's Individual Assistance program, FEMA's Disaster Unemployment Assistance (DUA) program, and Disaster Supplemental Nutrition Assistance Program (D-SNAP) . These are meant to support things like lost wages, food spoilage due to power outages, and other hardships — we want to ensure our members have frictionless access to these essential programs.

In the coming weeks, SaverLife will be releasing additional data and insights into the ways in which leaders and policy makers can advocate for equitable climate solutions that will reach and benefit those who are in dire need of support and protection. Be sure you are signed up for our newsletter in order to get our most recent climate findings delivered straight to your inbox.

Free resource

We encourage you to download and use this fact sheet in your efforts to raise awareness about the economic hardships associated with climate change.

More about The Downpour

We are grateful for the support of the Wells Fargo Foundation throughout this research initiative. The Wells Fargo Foundation has made it possible to better understand the lasting impact climate change is already having on SaverLife members’ financial health and to advocate for a green economy that’s informed by the LMI community.