SaverLife and Experian Launch Credit Partnership

For SaverLife members, savings and credit are inextricably linked. The pandemic has only strengthened the barrier that a low credit score places between our members and building financial security. Fifty-three percent of respondents to SaverLife’s Financial Health Survey indicate that they have a poor credit score. SaverLife members like Sylvia know that credit is essential for their financial future.

“I want to get credit card debt out of the way to boost my credit score, and then I can focus on other things like owning my own home,” Sylvia told us.

Establishing a strong credit score has never been more important. That’s why we’re thrilled to announce a new partnership with Experian. Experian is a leader in helping users protect, understand, and improve their credit. Through this partnership, SaverLife will leverage Experian’s expertise to enhance the credit literacy of our members, and help us develop a better understanding of user needs in this area.

“We know economic recovery – even entry into the credit ecosystem – can be a challenge for many, even when we’re not dealing with a financial and health crisis,” says Abigail Lovell, Experian’s senior vice president, Global Corporate Social Responsibility. “We are proud to help consumers and provide credit education; it’s a component of everyone’s financial health journey.”

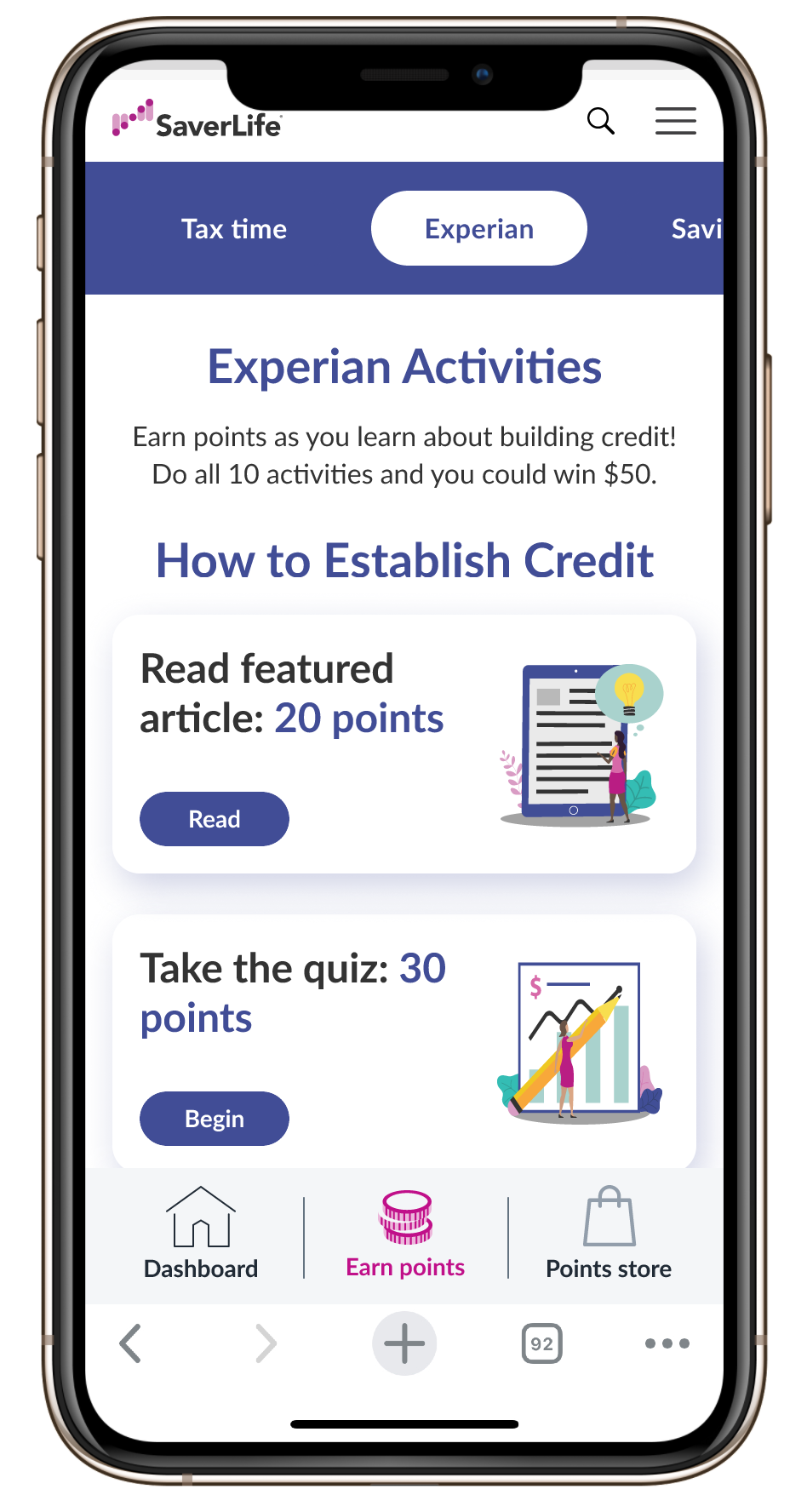

SaverLife launched a collaborative hub featuring Experian content on February 1. This hub will feature articles and quizzes that teach members how to establish good credit, improve their credit score, and learn what factors hurt their credit score. The goal of these articles is to provide quick, bite-sized information that is easy to digest and apply to members’ personal lives.

Members will earn points for reading the articles and taking the corresponding quizzes, and on March 15, 2021, SaverLife will randomly select 100 members who completed all the activities to win $50 each.

SaverLife will launch a robust promotional campaign to generate widespread interest in the new content, through social media, email newsletters, and digital ads. “We will also utilize our data to analyze how members further their understanding of credit by participating in the program,” says Leigh Phillips, SaverLife CEO. “We anticipate that improving credit scores, along with building an emergency fund, will help our members have greater long-term savings success and financial stability.”

Understanding and building credit is a major challenge for many Americans, particularly SaverLife members. Experian and SaverLife are committed to building efforts to integrate credit and debt features that improve financial health outcomes, just like this!