The Early Promise of the Child Tax Credit: Banking Data Indicates Increased Stability Through Savings

The expanded Child Tax Credit is showing early signs of financial stability through savings. Bank account analysis of SaverLife members shows that:

CTC recipients were 33% more likely to increase their savings by $100 and 18% less likely to have to significantly reduce their savings balances in August 2021 vs. August 2020.

Currently, the expanded Child Tax Credit is helping parents—whose expenses are significantly higher than non-parents—make ends meet.

If made permanent, it could have long-term impacts—like creating economic mobility for millions of families.

Lower-income Americans often struggle with unsteady, unpredictable incomes. This leads to habitually building emergency savings in rarer months of surplus and drawing down emergency savings the rest of the time.

New research from SaverLife shows that the expanded Child Tax Credit helps families build savings and allows them to maintain stable savings balances, to help weather an unpredictable economy.

“I was able to afford new clothes for my daughter when she started kindergarten. Having the payments now instead of a lump sum around tax season has helped a lot with paying for childcare which is super expensive.”

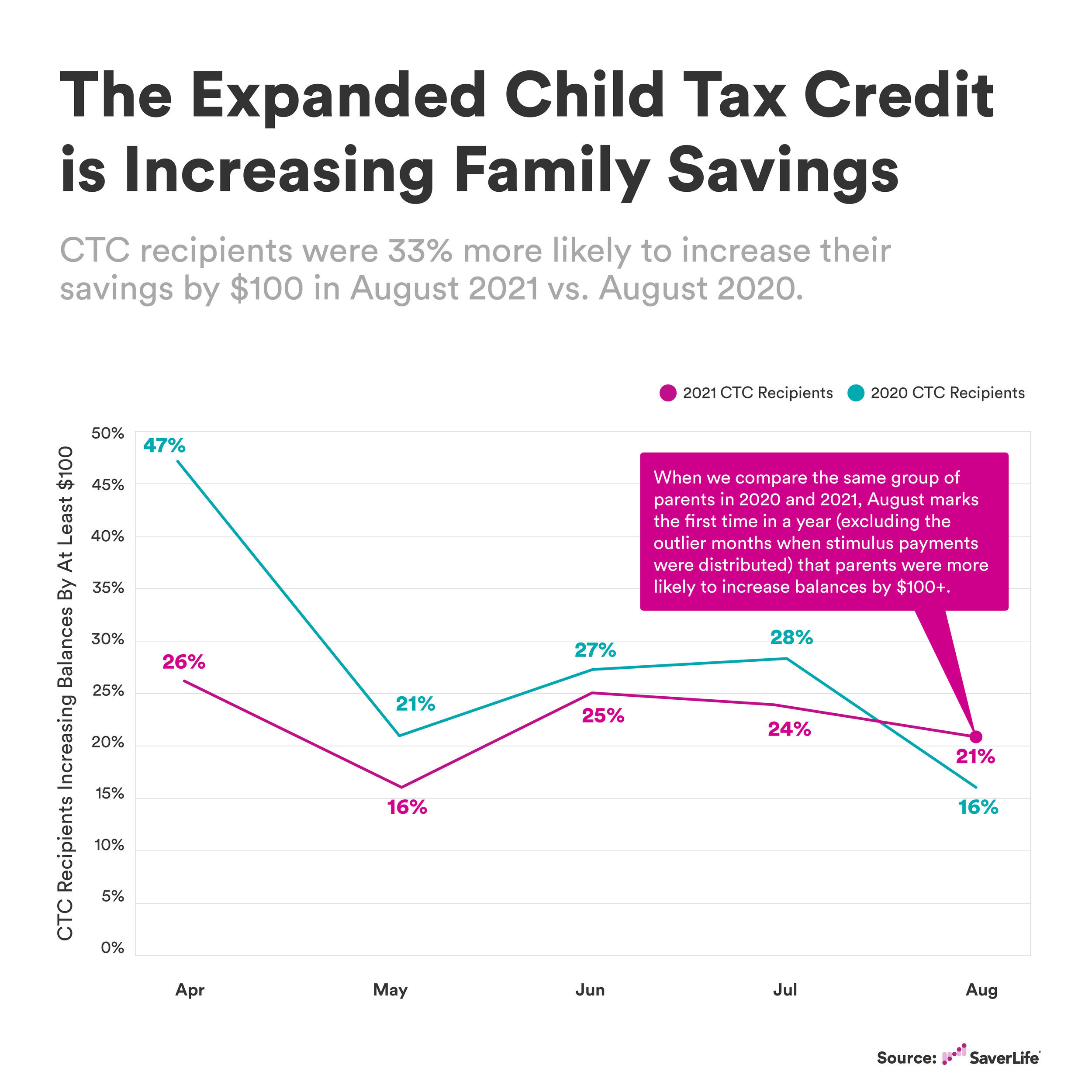

The Expanded Child Tax Credit is Increasing Family Savings

CTC recipients were 33% more likely to increase their savings by $100 in August 2021 vs. August 2020.

As of this analysis, families have received only two Child Tax Credit payments, but we’re already beginning to see signs of the payments having an impact. August marks the first month of 2021—not counting March when many families received stimulus payments—that CTC recipients were more likely to increase their savings balances by at least $100 versus the same month in 2020. In fact, CTC recipients were 33% more likely to increase their savings by $100 in August 2021 vs. August 2020.

“I’m able to create an emergency savings {account} for unforeseen circumstances.”

Parents are Keeping More Money in Savings Because of the Expanded Child Tax Credit

Similarly, July and August were the first two months in 2021, again other than March when stimulus payments were distributed, that fewer CTC recipients had to decrease balances by at least $100 vs. the same months in 2020. In August 2021, CTC recipients were 18% less likely to have to significantly reduce their savings balances.

“We’ve used our Child Tax Credit payments to pay for daycare and after-school services for our two kids, as well as making payments toward some debt.”

Being a Parent is Expensive

The Expanded Child Tax Credit Proves Just How Badly The Needs of Lower-Income Families Aren’t Being Met

When we polled our members to find out how they were planning to spend the CTC payments, most of them said they were spending on day-to-day needs. Our analysis of bank account data supports that. People are spending it on auto transportation, clothes, groceries, and utilities.

In every major spending category we analyzed, for every nearly every month, parents spend more than non-parents. That’s expected. What we didn’t expect to find is that this trend has only become more pronounced in July and August, when lower-income families—like SaverLife members whose average income is about $35,000—started receiving extra cash. They started using that cash to play catch up.

What this reveals is that the day-to-day needs of regular families, like the members of SaverLife, have a huge unmet need.

Furthermore, 89% know this is a temporary program, and are spending accordingly. If the expanded Child Tax Credit was made permanent, families tell us they would be able to better cope with day-to-day expenses AND make larger shifts to prioritize spending on tutoring for their children, moving to a better home, and starting a college fund for their children.

“The CTC is solely to take care of my children’s needs. I am awaiting September payments so that I can buy baby items and some fall clothing as my kids urgently need them.”

“Receiving the monthly funding has allowed me to save that money for upcoming school expenses such as clothing, supplies and other essentials. I did not have to use my credit card to pay for these purchases which is helping me not to add additional debit.”

Methodology

Savings charts: SaverLife analyzed the bank transactions of 16,130 members with linked bank accounts as of 1/1/2020. Savings data compares people where we can see a CTC payment in their bank account in July or August 2021 and compares that same group’s savings data in 2020.

Spending charts: SaverLife analyzed the bank transactions of 16,130 members with linked bank accounts as of 1/1/2020. All spending data compares people where we can see a CTC payment in their bank account in July or August to individuals where we can see neither. It looks at median spending by month, then averages of the medians are taken to look at broader time periods such as March - June or July - August.