Why Smart Fintech Design Leads to Better Outcomes

At SaverLife, we’re proud of the impact we’re making. To date, we’ve grown our member base to 170,000 members, and we continue to add new members at the pace of about 4,000 per month. But we want that number to increase, and one way we can do that is through smarter design.

We know that simple design changes can have a huge impact, so we’re constantly testing out different hypotheses to see how smarter design can improve SaverLife’s impact.

Hypothesis #1

Reducing “Mental Fatigue” Will Increase Bank Account Linkages

During onboarding we ask 13 demographic and 8 financial health questions before people linked their bank to SaverLife.

When we reviewed the data, we saw many people successfully completed the demographic and financial questions, but never linked their bank account.

Hypothesis #2

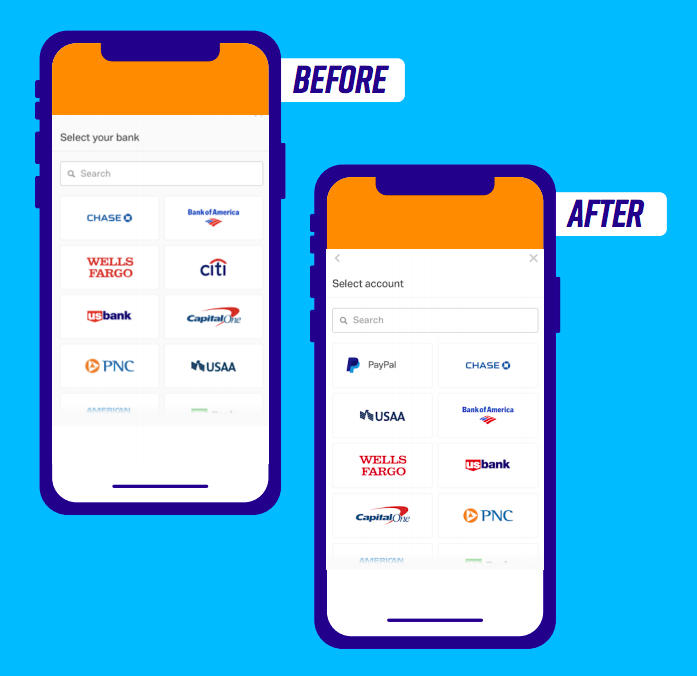

Making Paypal More Visible Will Lead to More Linked Savers

In prior research we learned that 74% of SaverLife Members have a PayPal account.

We saw a 5% increase in account linking after making this change. Most of the new linking came from PayPal.

While we’re excited that more people are linking, what remains to be determined is whether or not linking an account that isn’t typically thought of as a savings account leads to the types of savings outcomes we hope to see. Time will tell.

With these two changes to the SaverLife onboarding ow, bank account link rates have increased over 6%. This means a few more thousand opportunities per year to help working families save money, expand the SaverLife Community and its impact!

Design wields enormous influence, and when it is informed by qualitative and quantitative research, it makes a measurable difference in driving the impact metrics we want to achieve.