SaverLife Boosts Overall Financial Health Through Savings

Key Takeaways

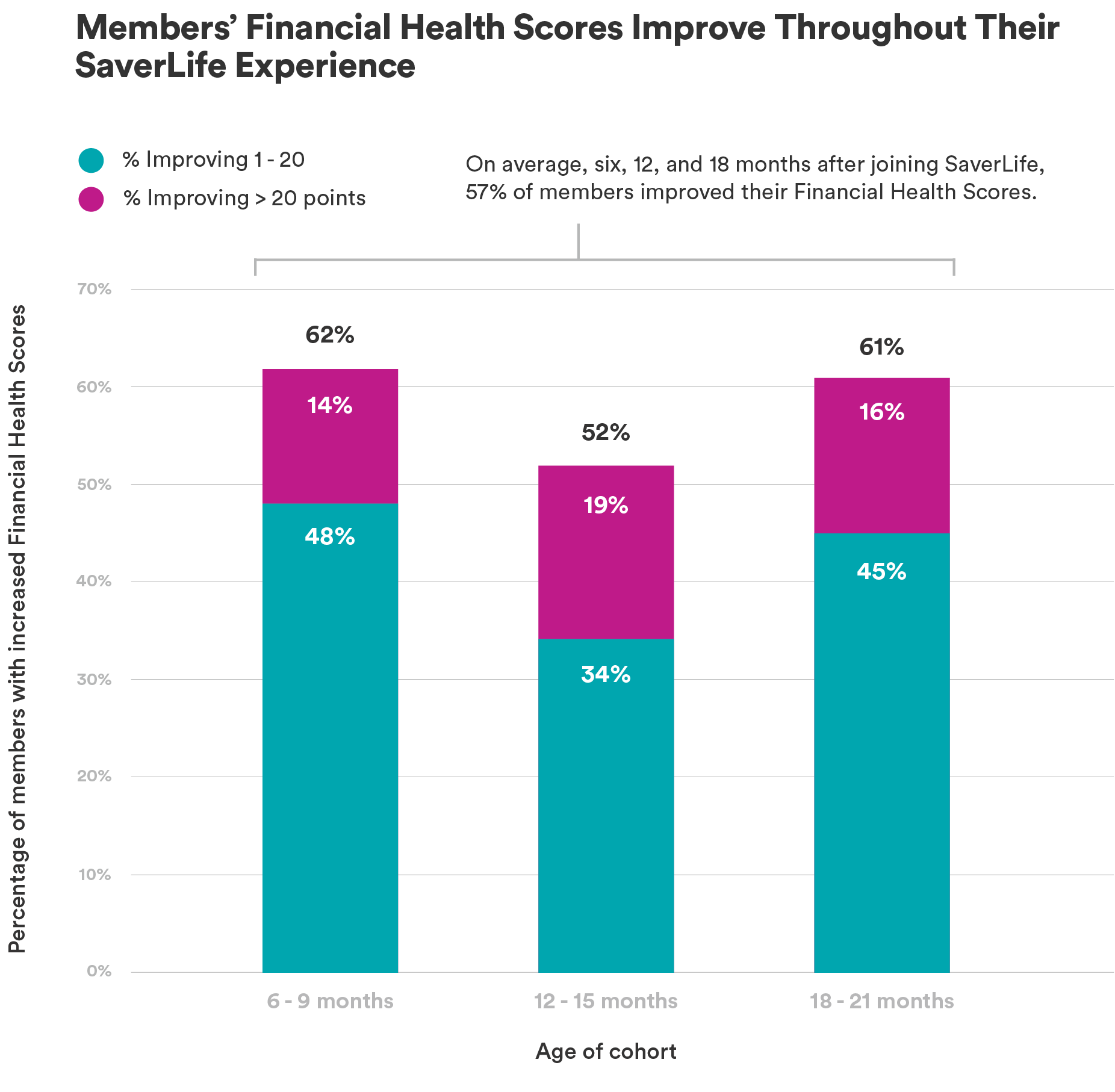

62% of members increase their Financial Health Scores within six months—and the savings habit members build is a key reason why.

Members are:

50% more likely to say their liquid savings can cover at least one month of expenses after six months.

30% more likely to indicate they have a manageable debt level after 18 months.

79% more likely to say they’re confident that the members of their household are doing what they need to do to reach their longer-term financial goals after 18 months.

SaverLife leverages the Financial Health Network’s FinHealth Score® Toolkit to determine if members’ daily financial systems allow them to be resilient and pursue opportunities over time.

The median income of a SaverLife member is between $25,000-$35,000, and two-thirds of new members link an account with a savings balance of less than $100.

A SaverLife member is 1.9x more likely to be considered “financially vulnerable” than the national average at sign-up.

At sign up, 50% of the members in this study were “financially vulnerable,” and 47% were “financially coping” (vs. national averages of 17% financially vulnerable and 50% financially coping).

Just 2% of participants were considered financially healthy when they signed up.

What is the Financial Health Score®?

The FinHealth Score® is based upon the following definition of financial health:

Financial health comes about when your daily financial systems allow you to be resilient and pursue opportunities over time.

Financial health is a composite framework that considers the totality of an individual’s financial life. Unlike narrow metrics like credit scores, financial health considers whether individuals are spending, saving, borrowing, and planning in a way that will either contribute to or detract from, their resilience in the face of unexpected events and ability to thrive in the long term.

The numerical value of the Financial Health Score aligns with the following nomenclature:

SaverLife Members Improve Their Financial Health Over Time

SaverLife members frequently improve their overall financial health after joining, despite consistently low, unpredictable incomes. In a recent analysis, an average of 57% of members improved their Financial Health Scores at six, 12, and 18 months after joining SaverLife—and many of their scores rose significantly (more than 20 points).

Short-Term Savings Improvements Are a Major Driver of Overall Financial Health

Low wages, income volatility, and increases in the cost of living make it difficult for American households to build and maintain short and long-term savings, as evidenced by the fact that: 37% of Americans don’t have a savings cushion of $400.

SaverLife has consistently proven that even a small amount of savings correlates with greater financial stability, especially for people with lower incomes.

Short-term savings enable people to survive a financial emergency, like a leaky roof, an emergency filling or absorb expense or income shocks stemming from a natural disaster. A financial cushion helps members protect themselves from increased debt, missing payments on bills, or worse.

Before joining SaverLife, 55% of members reported having a week’s worth of expenses saved. Eighteen months later, that number increases to 80% of members, a 45% increase.

After six months, members are 50% more likely to say their liquid savings can cover at least one month of expenses.

SaverLife Members Improve Other Core Tenets of Financial Health

Saving is one part of an individual’s financial health. Income, debt, expenses, and planning also play a part. If savings balances increase while debt increases, net wealth or net liquidity may suffer, and someone’s overall financial health may not improve.

Fortunately, SaverLife members also improve their relationship with debt at the same time they’re increasing savings. After 18 months, members are 30% more likely to indicate they have a manageable debt level.

These improvements in short-term savings and debt levels correlate with increased confidence in reaching longer-term goals.

After six months, members are 30% more likely to say they are confident they will reach their longer-term financial goals.

Members Are Able to Make Financial Health Improvements Despite Challenges Earning Enough Money to Cover Expenses

SaverLife members earn much less than the national average—the median income of a SaverLife member is between $25,000-$35,000, and two-thirds of new members link an account with a balance of less than $100.

70% of SaverLife members experience income volatility.

Over the past several decades, the purchasing power of that income has declined. SaverLife research has consistently demonstrated that new income (like influxes of cash) is used to cover basic, day-to-day expenses, such as groceries, utilities, debt, and transportation, or saved to be used for those items within a few months. This likely helps explain why SaverLife members’ spending remains equal to, or eclipses, income over time.