Navigating Income Volatility as a Barrier to Savings Success

in partnership with

In 2017, SaverLife set out to better understand how income volatility affects the American workforce. The goal was to identify savings solutions that would lead to greater financial stability for households experiencing uneven income.

SaverLife originally hypothesized that only a small percentage of SaverLife members experienced frequent income volatility, for example, those working in the platform-based gig economy. The organization began a thorough review of published literature and research, interviewed members, and undertook three research sprints to better understand income volatility among low-income American working families. The initial plan was to build a separate savings intervention alongside SaverLife, to be used by a subset of members.

Income volatility is defined as a 25% spike or

dip in income on a month-to-month basis.

Research in the field and observation of the experience of income volatility among SaverLife’s members proved the original hypothesis incorrect. SaverLife found that income volatility is pervasive and widespread. More than 70% of SaverLife members experience income volatility, with frequent dips and spikes in income of over $1,000. As a result of this research, SaverLife pivoted towards a complete redesign of the core platform, which is now focused on support for working Americans looking to build greater stability in an unstable financial environment.

The Depth and Breadth of Income Volatility among SaverLife members

Through research and data analysis, SaverLife found that income volatility is ubiquitous among members. A review of transactional data showed that the typical SaverLife member experiences income volatility three out of every four months. This income volatility is defined as a 25% income change from their average income over the prior two months.

SaverLife members report a median yearly income of $20,000, and transactional analysis shows that the median monthly dip in income that members experience is $1,208, while the median monthly spike is $1,346. In contrast to prevailing thought, not all income volatility events are dips – over half (55%) are shown as a spike in income.

These significant swings make it challenging for members to manage their immediate finances and plan for the future. Volatility also takes a toll on members’ emotional well-being. In interviews, SaverLife members reported increased personal stress and tension with family members in times of lower income. They also report that volatility makes it harder for them to maintain their ideal quality of life and reach their financial goals.

How do SaverLife members get by?

Members report that they manage their finances by borrowing from friends and family and delaying bill payments. Months with higher income often mean an obligation to repay these debts and bills that were delayed or only partially paid. Some members rely on public benefits such as SNAP or unemployment. Others make quality of life sacrifices or simply or cut corners to make ends meet.

Product Prototyping & Decision Making

After learning how widespread inconsistent income is among SaverLife members, the organization began a two phase design process to develop a savings solution that works for people experiencing income volatility.

Phase 1: Discover and Define

SaverLife completed a thorough review of published literature and research on income volatility. SaverLife staff also interviewed 16 academic, practitioner, and fintech experts about income volatility and potential solutions. The organization also undertook four research sprints to better understand income volatility among members.

Phase 2: Design and Prototyping

This phase focused on testing product-market fit for a wide range of income volatility savings solutions through rapid prototyping. SaverLife created a prototype for a standalone product called Squirrel Away. The product was prototyped with specific interventions to help members with an inconsistent income save regularly.

Pivot to SaverLife 2.0

Throughout SaverLife’s in-depth research and observation during the research sprints and prototyping the viability of the Squirrel Away product, understanding of income volatility's effect on SaverLife members evolved. SaverLife ultimately found that income volatility is widespread among the membership, with more than 70% of members experiencing regular income swings over $1,000. To address this, SaverLife pivoted from a standalone product to a redesign of our core platform. Launched in spring 2019, SaverLife 2.0 is optimized to support all members on their savings journey, with a focus on those with inconsistent incomes.

Product Innovations of SaverLife 2.0

“While members only need $5 to be eligible for a scratch card, weekly savings deposits are often higher than $5. Members routinely saved $20, $50, $75, and even $100 per week. ”

Scratch & Save vs. Matched Savings

Scratch & Save is a product that gamifies the savings experience. When saving more than $5, members receive a digital scratch card. When SaverLife launched a ten week trial of Scratch & Save, members were initially given one free card. Members that played their free card in week 1 increased their savings by 14% on average. Members that played their free card and won were 100% more likely to play and save again. After the first week, members that played Scratch & Save were 30% more likely to save again the following week than those who didn’t.

Over a ten week pilot of the program, more than 3,000 unique members saved at least $5 in a week and scratched 8,347 cards. During that time, email open rates among eligible members were consistently above 40%, far higher than typical open rates and industry averages.

Scratch & Save is now a key component of SaverLife 2.0, and motivates SaverLife members to save when they can. When members save more than $5 in a week, they receive a scratch card on Monday morning. Each week, 200 members have the chance to win $5, and members typically win one in five times.

2. The Race to $500

SaverLife introduced time-bound savings challenges in SaverLife 2.0, with the goal of encouraging members to grow their savings by a certain amount within a fixed window of time. The hypothesis was that members who experience income volatility may not be able to save consistently, but can stash away $100, $250, or $500 when income is higher than normal.

The Race to $500 challenged SaverLife members to save $500 over the course of two months, in order to have a financial cushion going into the holiday season. Members in the race could qualify for Gold, Silver, or Bronze level prizes depending on how much they saved. Participants were able to view real-time dashboards showing the savings of other members, and join an active online group to share encouragement and savings tips.

SaverLife data shows that members who opted in saved an average of $63 more than those not competing in the Race to $500. Members who opted into the race were 65% more likely to have saved at least $100 during the race, than had they not joined.

3. Tax-Time Quest

Tax refunds are a key driver of positive income volatility for the average SaverLife household, and a prime savings opportunity. To capitalize on this cash infusion and build on prior tax savings momentum, SaverLife designed the Tax-Time Quest. The Tax-Time Quest begins with a pledge, in which members specify what they are saving their tax refund for and how much they would like to save. By pledging, members make the personal commitment to save their refund. Members earn points for engaging with tax content and resources to further maximize savings opportunities during tax season. The Tax-Time Quest culminates with a story contest where members share a savings story and a photo to be eligible to win a $5,000 grand prize. SaverLife surprised winners with the check, creating videos to inspire others to save during tax time in future years.

SaverLife found that low-income tax filers save a portion of their refund at higher rates than previously thought or measured, and are more successful in following through with saving their refund when using SaverLife. In 2019, more than 45,000 people pledged more than $60 million of their tax refunds, and were 2.5x more likely to save than those who did not take the pledge.

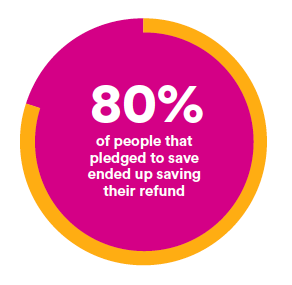

SaverLife also completed a study in 2019 focused on understanding tax time savings in low-income populations. Completed in collaboration with Prosperity Now and the Social Policy Institute at Washington University in St. Louis, the study asked tax filers if they intended to save their refund and followed up to ask if they saved any of it after they received the refund. The study found that 80% of SaverLife tax filers that intended to save did save their tax refunds.

What’s next for SaverLife 2.0

Race to $100

Building on the success of the Race to $500, SaverLife has launched a new challenge in March 2020, the Race to $100. After the close of the Race to $500, some members reported that the $500 goal seemed insurmountable. SaverLife is currently testing the $100 savings goal as a more attainable savings sum.

Income Volatility Prediction Model

SaverLife is also preparing to launch an Income Volatility Tracker in the second quarter of 2020, with the goal of predicting the income dips of members. Built in collaboration with data scientists at Datables, the tracker uses machine learning to predict whether or not members will experience an income dip. The Income Volatility Tracker will be rolled out as a public-facing dashboard, and SaverLife will integrate the learnings into future product offerings.

In 2017, SaverLife set out to create a standalone product for low-income Americans affected by income volatility, to exist alongside the SaverLife 1.0 platform. Through research and rapid prototyping, SaverLife found that the initial hypothesis didn’t represent the impact of income volatility on SaverLife members.

After research and many user tests, SaverLife 2.0 was launched, with an innovative suite of products that allow SaverLife to support members in saving despite persistent income instability. SaverLife 2.0 has shown strong savings results in preliminary interventions and SaverLife will continue to innovate new products on the road to reaching 1,000,000 members.