Is it Possible to Save While Paying Down Debt?

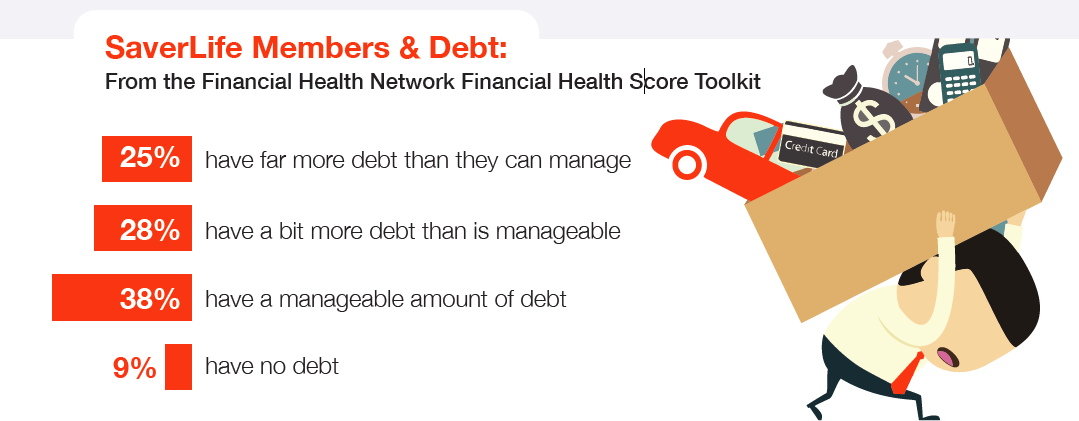

Americans have more credit card debt than savings.

Credit card debt can make saving more difficult than other kinds of debt.

Because credit card debt is considered “bad debt,” whereas other kinds of debt (mortgage, car, student loans, etc) are seen as “long-term investments in an asset”), there is a stronger urgency to pay it off rather than save.

SaverLife Data Proves It - You Can Pay Down Debt AND Save

People across all levels of debt can save.

This is true across the entire income spectrum.

Savers with more than $1K in debt are able to increase their savings but often prioritize debt payments first.

*net savings change in the six months before SaverLife vs. the six months after

Experts Agree: The Solution is Paying Down Debt and Saving

Not having an emergency fund means having to rely on credit card again and again. Work towards both goals concurrently. CNN Money

Having credit card debt without emergency savings, dooms us to stay in credit card debt. The Motley Fool

Shore up defenses (emergency savings) before going on offense (paying down credit card debt) You Need A Budget (YNAB)

Savers Weigh In

Based on the habits of SaverLife Members, the conventional wisdom that one should focus on paying down debt before building short-term savings, might be correct when credit card debt is above $1,000, but when credit card debt is at more modest levels our Members make it clear that building a savings buffer can and should be a priority.

"I keep track of my saving by the SaverLife emails, so I just save the amount you ask me to save and don’t think about my credit cards at that time. I have been saving a lot more recently, so it is a really good help. Before that, I would try to save after my bills were paid.” - Nikki

“Don’t let the debt get higher. Make your minimum payments, but then start off with saving 5% of your income - you can trim it from your budget somewhere. Little things add up." - Michael