The Parent Trap: Work, School, and Parenting Are Putting Low-Income Parents In an Impossible Bind

While the pandemic has impacted all parents of school-age children across the country, the struggles of low-income families are even more pronounced. In this report, we explore the disparate impact of the pandemic on the parents we surveyed.

Less paid work means less income

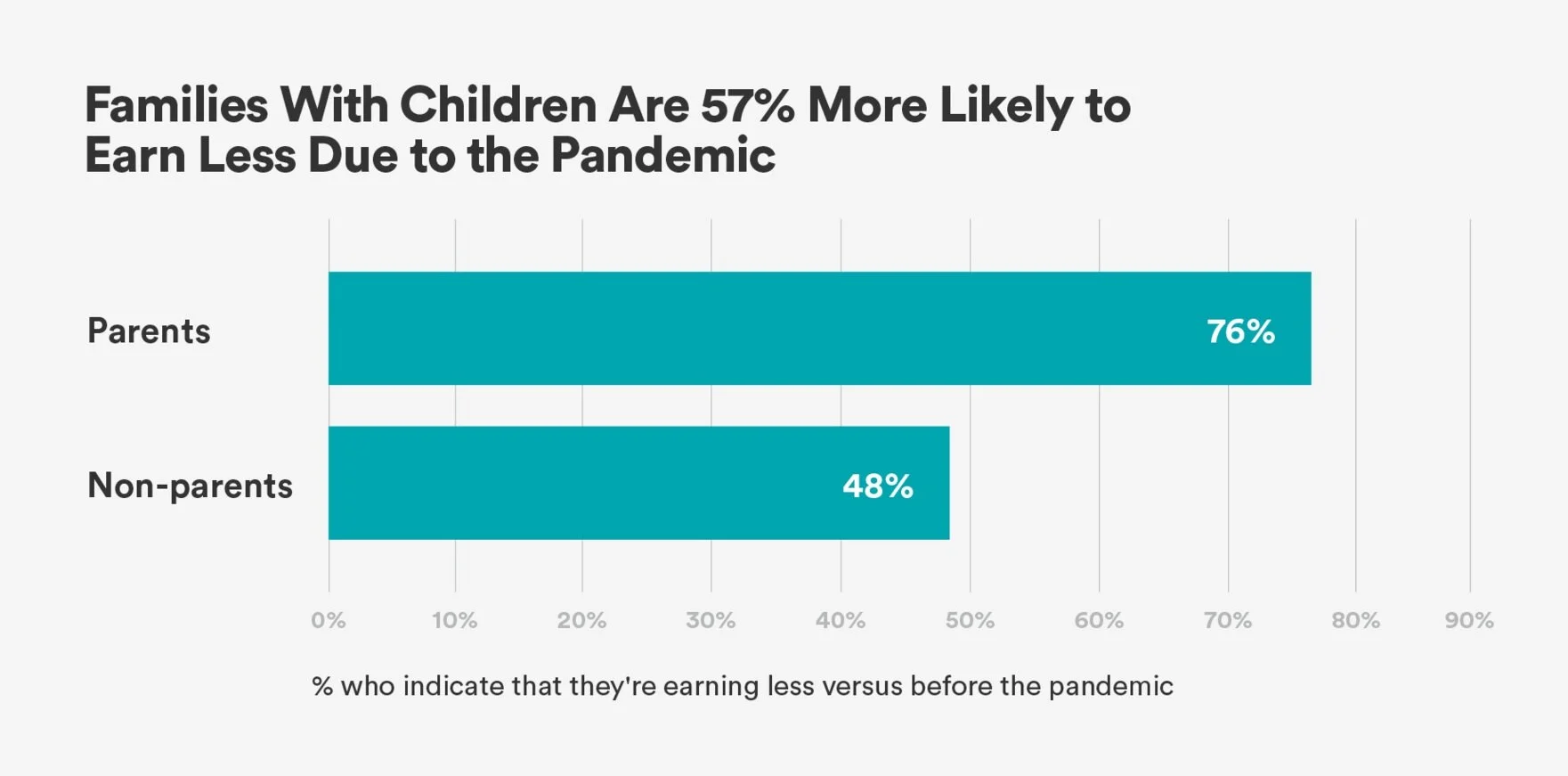

Households with dependent children are faring worse economically than those without children—seventy-six percent of parents report earning less money now compared to pre-pandemic. This is a 57% increase vs. non-parents.

Sixty-eight percent of parents say their children aren’t attending school in-person—making it increasingly difficult to earn income.

Half of all American children are still learning virtually, and even schools that are “open” are often not running at full capacity—utilizing smaller cohorts and shorter schedules to adhere to public health guidelines. That means more children are home, and have been for almost a year—creating an untenable situation for their parents.

When comparing the parents of remote-schooled children to parents whose children attend school in-person, the parents of remote-learning children are 35% more likely to say caring for children is making it more difficult to earn money.

When we compare how much less people are earning, those with remote-learning children are 47% more likely to say they’re earning at least $500 less per month than they were earning before the pandemic vs. parents whose children are attending school in-person.

Compounding the problem: remote-schooling means higher costs

Income is going down and expenses are rising. Parents with remote-schooled children are 46% more likely to say their expenses have increased during the pandemic compared to non-parents, and 19% more likely compared with parents whose children are learning in-person.

These results are even more striking for people of color, as 82% of non-white members with children indicate that their expenses have increased during the pandemic (vs. 72% for white members).

The increases are significant. Of the parents who indicated that their expenses were higher, those with remote-schooled children are 35% more likely to say their expenses have increased by $500 or more a month than parents whose children attend school in-person.

What’s driving up expenses?

Food

The primary driver of the expense increases is likely food, as parents with remote-schooled children are 53% more likely to attribute increased expenses to food vs. non-parents, and 15% more likely to attribute increased expenses to food vs. parents with children attending school in-person. Government assistance has not been enough to cover the increased costs.

Childcare

Without the childcare and support provided by open schools, parents of remote-schooled children are reporting increased costs for childcare and school supplies. Pre-pandemic, many members relied on extended family for help, but for the past year, 69% said they weren't able to leverage childcare through friends or family.

The reality is grim, but solutions are on the table

The situation for low-income parents of remote-schooled children is dire. These parents are earning less money and facing increased expenses while being forced to make impossible choices between work and family. This untenable situation has existed for a year and been met with inconsistent government support specifically for low-income parents with remote-schooled children.

These parents form a sizable voting bloc and have strong opinions on how the government could alleviate their struggles. For example, in a January poll, 30% of SaverLife members indicated that the highest priority for the new administration should be expanding the child tax credit.

Policymakers must think short-term and long-term. Well before the pandemic, low-income families were waging an uphill battle against poverty and inequality—and the COVID-19 pandemic has only made things worse. It’s the product of years of policies that keep low-income families trapped in the cycle of poverty. Now is the time to start undoing harm and redesigning the way we systematically address opportunity and mobility in our society and culture.

Current relief proposals under consideration that SaverLife supports include:

Make direct cash payments: There is overwhelming proof that shows that cash makes a significant difference in helping families make the choices they need to, from paying rent to buying groceries.

Reopen schools safely: Support teachers and districts in following reopening guidelines and ensure all students have the resources and support they need to succeed.

Provide increased childcare subsidies: help make childcare more available and affordable, and ensure a living wage for childcare providers and early childhood educators.

Fight child poverty with an expanded child tax credit to give working families more cash at tax time and throughout the year.

Support the hardest-hit communities at the front line of the health and economic COVID-19 crisis, including providing targeted support to small businesses, especially those owned by entrepreneurs of color, and recognizing and protecting essential workers.