The United State{s} of Savings

SaverLife members are putting money away when they can, but the ability to save consistently remains elusive.

Despite not being financially satisfied, SaverLife members remain optimistic about their futures.

SaverLife Responds

Our members are optimistic and resourceful—savings is more important now than ever and despite setbacks, they continue to grow their balances.

By the end of 2022, we will double our membership to reach one million members. We are launching targeted campaigns to provide greater support to SaverLife members in specific metro areas and demographic sectors.

SaverLife technology creates a habit of savings through engaging challenges and tips on how to manage spending, debt, and gaps in income.

SaverLife is releasing a mobile application in the iOS and Android app stores that will include personalized nudges to increase engagement, which correlates with increased savings.

SaverLife believes economic mobility is achieved through individual savings and the eradication of entrenched systemic barriers.

SaverLife advances a member-driven policy agenda. We leverage our unique access to stories and data to inform policy makers, academia, and advocacy groups of key insights and trends while informing our members of critical supports that are proven to help them.

At SaverLife, we envision a world where all people in the United States can build wealth and create a prosperous life for generations to come. We believe that the key to prosperity starts with a savings habit.

State of Savings Atlanta

Optimism in the Face of Adversity

SaverLife’s Atlanta members struggle to earn income compared to national averages. Savings rates in Atlanta trail national averages and members in Atlanta are 9% more likely to say they don’t earn enough money to set any aside.

In 2021, Atlanta members trail the national average in their ability to make significant savings gains (defined as increasing their balances by $100 or more in a given month) in six out of nine months.

State of Savings Detroit

Believe in Us. We Believe in Ourselves.

SaverLife’s Detroit members struggle to earn income compared to national averages, and financial resilience remains elusive. The barriers are high in Detroit—despite similar demographics to the national membership, Detroit members are 31% more likely to be considered financially vulnerable, and 71% less likely to be financially healthy when compared to national averages.

State of Savings Washington, DC

Job Quality and Consistent Income Are Key

Washington, DC SaverLife members have steadier incomes, save more consistently, and routinely outpace the national average in their ability to make significant savings gains. In 2021, a greater percentage of Washington, DC members have increased their savings balance versus national averages in eight out of nine months.

National State of Savings

What’s Working

Cash infusions

Typically, the greatest opportunities for members to save come after infusions of cash, like stimulus payments or tax refunds. This year, those infusions were more critical, as SaverLife members struggled with unemployment, inconsistent income, and increased expenses.

Resourcefulness

Despite incredible setbacks and an ever-changing landscape, we’ve seen 158% growth in membership since the beginning of the pandemic—savings is more important now than ever. With SaverLife, members build a habit of saving.

Optimism

Only 16% of SaverLife members report being currently financially satisfied, yet the same cohort is more than twice (41%) as likely to be confident in their ability to reach financial goals that they set for themselves.

What’s Not Working

Not enough income

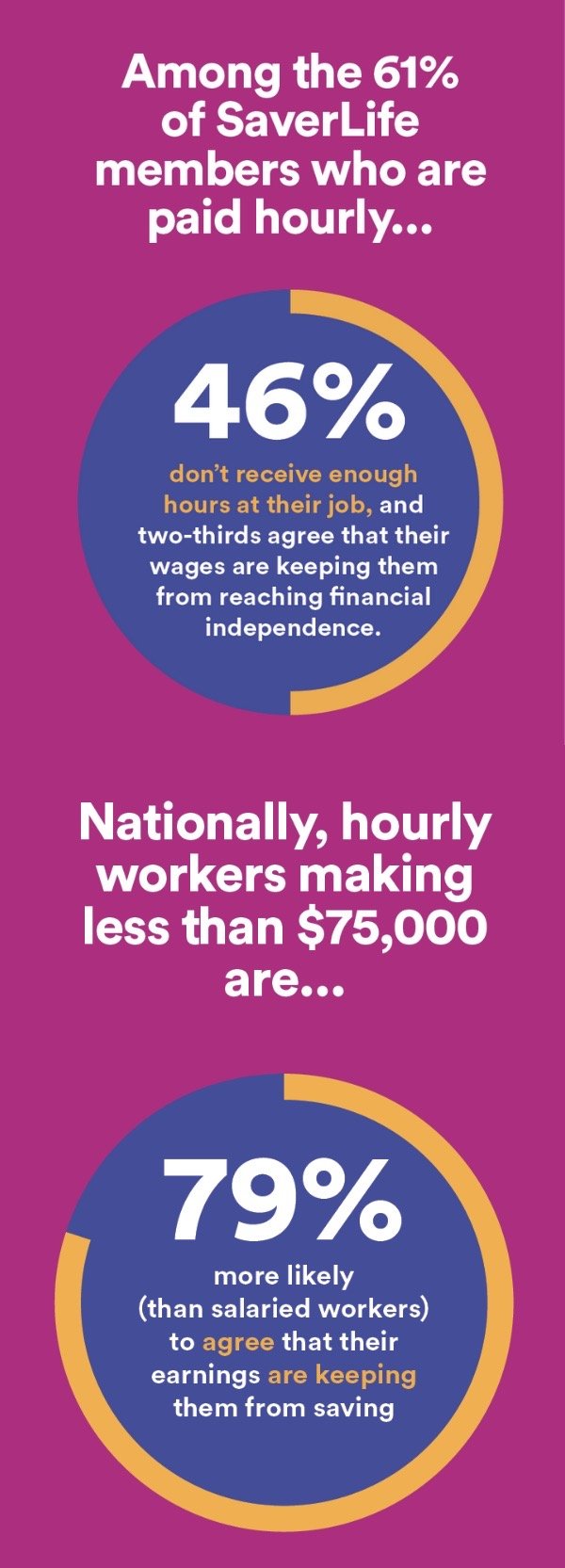

SaverLife members feel that they don’t earn enough at their jobs to save regularly. Seventy-four percent of members indicate they don’t earn enough to set money aside, and 26% of members work more than one job to make ends meet.

Spending

As many people are getting back to work, spending is returning to pre-pandemic levels, but full-time employment still lags, and many members report they are not making as much as they did in 2019, further impacting their ability to save. Spending on groceries increased greatly at the start of the pandemic and remains elevated. Median grocery spending in 2020 was 20% higher than it was in 2019, and this increased spending is continuing in 2021.

Transportation spending was 37% higher in March - June 2021 vs. the same time frame in 2020.

Restaurant spending was 40% higher in March - June 2021 vs. the same period in 2020.

Debt

Members are paying down elevated credit card balances from 2020, but balances remain 23% higher in June of 2021 vs. June of 2020. Yet, members are paying on average 8% more each month towards their balances.

Savings and the Racial Wealth Gap

SaverLife members of color retain more optimism than white members and are:

6% more likely than the national average to increase their savings in any given month

50% more likely to agree that they’ll reach the financial goals they set for themselves

However, SaverLife members of color are:

11% less likely to indicate that they’re getting by financially (50% vs. 56%)

3% more likely to say they don’t earn enough to set money aside

30% more likely to be working more than one job