State of Savings: Atlanta

Optimism in the Face of Adversity

SaverLife’s Atlanta members struggle to earn income compared to national averages. Savings rates in Atlanta trail national averages and members in Atlanta are 9% more likely to say they don’t earn enough money to set any aside.

In 2021, Atlanta members trail the national average in their ability to make significant savings gains in six out of nine months.

WHAT’S WORKING

Individual Resourcefulness & Dedication

Despite being less financially satisfied than their national peers, Atlanta members have nearly identical Financial Health Scores, showing that despite challenges, they’re doing what they can to build financial stability.

WHAT’S NOT WORKING

Income Consistency & Availability

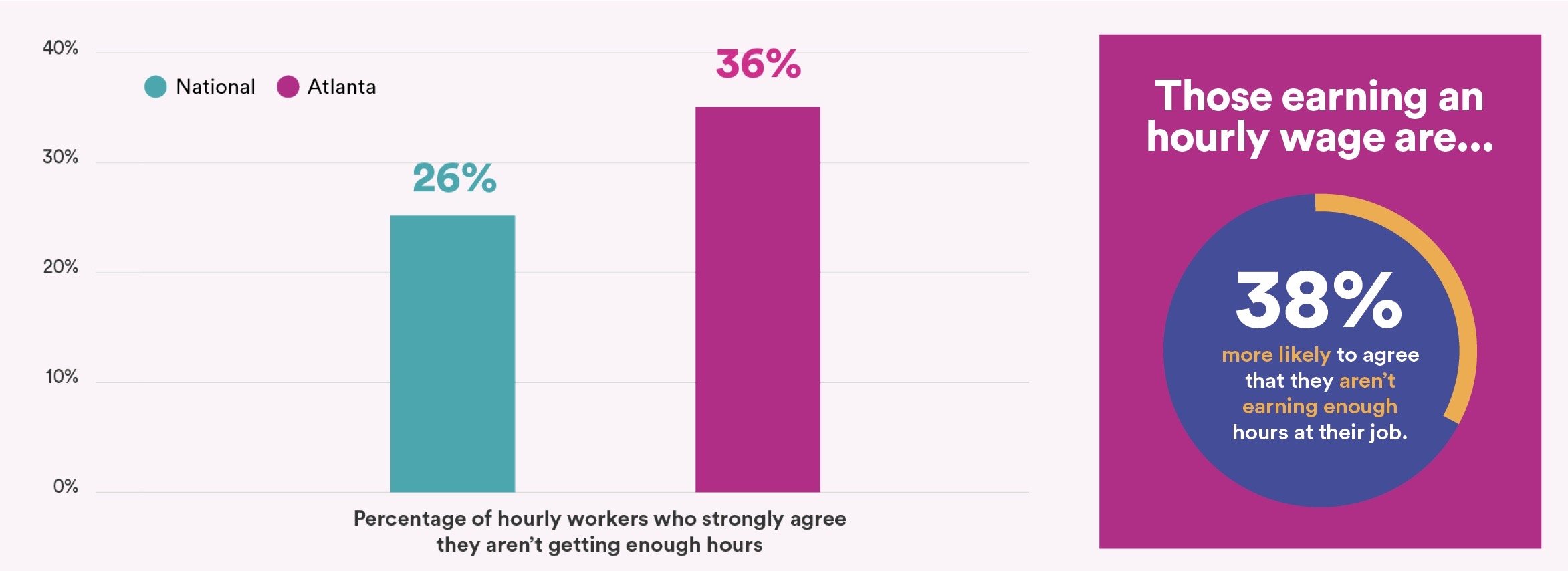

Atlanta members struggle to earn consistent income—they are more likely to be paid hourly and struggle to earn enough hours. The data across regions suggest that salaried employment is correlated with higher levels of saving vs. hourly employment, even though other demographic factors, including household incomes, are similar.

Debt

Atlantans have also struggled to pay down credit card bills to build much needed liquidity. Since March, Atlanta member credit card payments have trailed the national average by 26%.